But if you’d rather get a paper version, you can order Form D-410 by calling 1 (877) 252-3052 or by going to the “Order Forms” webpage: /forms/orderįor more information, please visit the North Carolina Department of Revenue website: dornc.

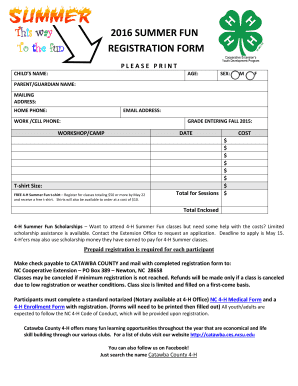

The State of North Carolina urges individuals to electronically file (“e-file”) their tax extension. Your extension request can be filed and paid electronically via North Carolina’s Online Filing and Payment system: /electronic/individuals If you owe North Carolina tax, remember to make an extension payment with your request and submit Form D-410 by the original due date of your return (April 15). Included in this price are transportation, lodging, meals while at camp, all activities, camp store card, and camp t-shirt. To request an extension, use North Carolina Form D-410 (Application for Extension for Filing Individual Income Tax Return). Reserve your spot with a 50 deposit due to the Extension Office by March 4 Total cost of camp is 450.00. While you aren’t required to make a tax payment with your extension, any balance not paid by the original due date (April 15) will be subject to interest and penalties. It’s important to note that a tax extension only applies to filing - it does not extend the time you have to pay state income tax. If you cannot file on time, you can get a North Carolina tax extension.Ī North Carolina personal extension will give you 6 more months to file, moving the deadline to October 15 (for calendar year taxpayers).

For calendar year filers, this date is usually April 15. North Carolina individual income tax returns are due by the 15 th day of the 4 th month after the close of the tax year.

0 kommentar(er)

0 kommentar(er)